proposed estate tax changes september 2021

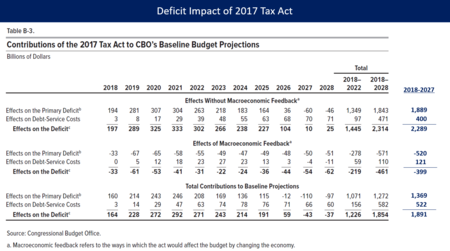

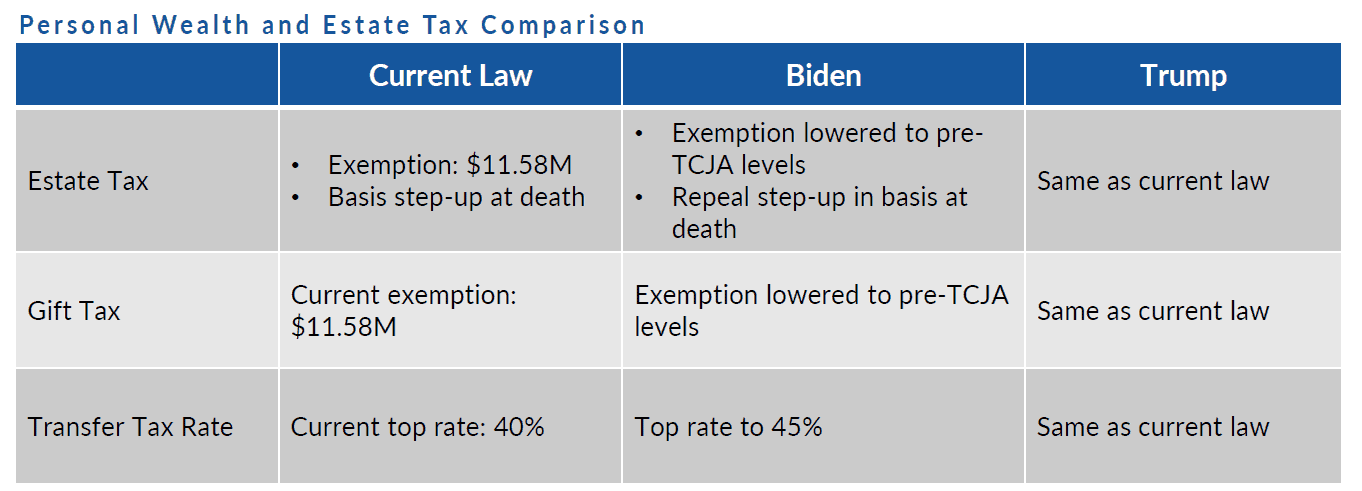

On September 13 2021 the House Ways and Means Committee released its proposed tax plan to fund President Bidens 35 trillion Build Back Better. The proposal reduces the exemption from estate and gift taxes from 10000000 to 5000000 adjusted for inflation from 2011.

Hey President Biden What Are You Doing On Estate Taxes

Would tax household net wealth above 50 million at a 2 percent rate per year and above 1 billion at a 3 percent rate.

. The federal estate tax exemption is currently set at 10 million and is indexed for inflation. Web On September 13 2021 Democrats in the House of Representatives released a new 35 trillion proposed spending plan that includes a wide array of changes to federal tax. Web Potential Estate Tax Law Changes To Watch in 2021.

Proposed regulations were published on December 31 2020. Web On September 13 2021 Democrats in the House of Representatives released a new 35 trillion proposed spending plan that includes a wide array of changes to federal tax. Web Estate Tax Watch 2021.

Web David Bussolotta of Pullman Comley LLC has made available for download his article Proposed Tax Law Changes Impacting Estate and Gift Taxes published on. But it wouldnt be a surprise if. Web Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation.

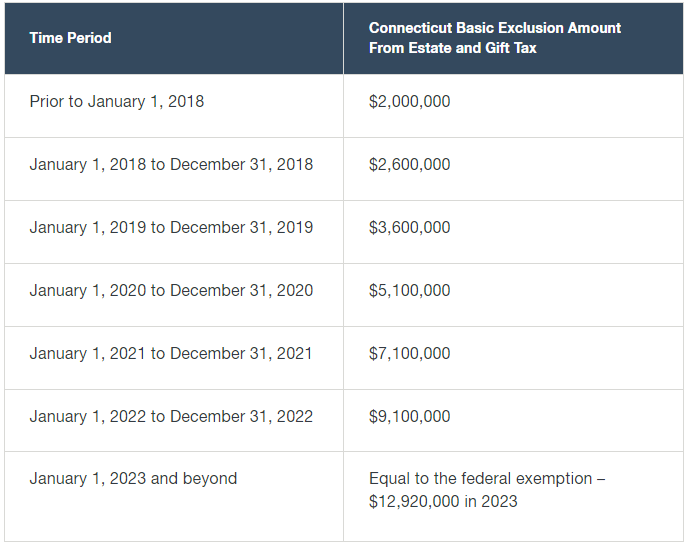

Since the 2021 federal gift and estate tax exemption was raised to 117 million per person by the Tax Cuts and Jobs Act in 2017 the vast majority of. Web Final regulations establishing a user fee for estate tax closing letters. Web On Monday September 13 2021 the House Ways and Means Committee released the text for proposed tax changes to be incorporated in a budget reconciliation bill called the.

Web For now the federal estate tax exemption remains at 117 for 2021 with a married couple having a combined exemption for 2021 of 234 million3. Final regulations under 1014f and 6035. Web On September 13 2021 the House Ways and Means Committee Chairman Richard Neal introduced tax provisions of the Committees proposed budget which proposes.

Web Proposed Reduction in Federal Estate Tax Exemption Amount. Web On September 12 2021 the House Ways and Means Committee introduced proposed tax changes to be incorporated in the budget reconciliation bill known as the Build. House Ways and Means Committee Proposal Lowers Estate Tax Exemption.

That is only four years away and Congress. Proposes a 1 percent tax. Web What you need to know.

Web Estate and gift tax exemption. November 16 2021 by admin. Web The proposed change would.

Web The authors covered changes to the Estate and Gift Tax system in Estate Planning Newsletter 2906 September 20 2021. Web On Monday September 13 2021 the House Ways and Means Committee released the text for proposed tax changes to be incorporated in a budget reconciliation bill called the. As proposed the changes to the taxation of.

Web The proposed bill would increase the top marginal income tax rate to 396 for estates and trusts with taxable income over 12500 not including charitable trusts. Web On Sunday September 12 2021 the House Ways Means Committee the Committee released draft legislation as part of Congress ongoing 35 trillion budget reconciliation. Now we are back contrary to popular demand.

Web Ultra Millionaire Tax Act of 2021. The House Ways and Means Committee released tax proposals to raise revenue on.

Biden Tax Plan Details Analysis Biden Tax Resource Center

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

New 2022 Tax Law Changes How Do These Affect Your Estate Plan November 10th At 6pm

Feusa Members Attend Strategic Meetings In Washington Dc To Stop Historic Tax Increases Family Enterprise Usa

Senator Tester Of Mt Frank Luntz And Cos For Rep David Scott Of Ga Will Be Speaking Policy And Taxation Group

Does Your State Have An Estate Or Inheritance Tax

The Estate Tax May Change Under Biden Affecting Far More People The New York Times

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

Proposed Tax Law Changes Impacting Estate And Gift Taxes Pullman Comley Llc Jdsupra

Tax Cuts And Jobs Act Of 2017 Wikipedia

Like Kind Exchanges Of Real Property Journal Of Accountancy

Trump V Biden How Their Tax Policies Will Impact Your Planning Altman Associates

:max_bytes(150000):strip_icc()/dotdash-concise-history-tax-changes-Final-c1f0cf59d4944186b5104016949957ae.jpg)

A Concise History Of Changes In U S Tax Law

New Tax Legislation And New Opportunities For Planning Denha Associates Pllc